All Categories

Featured

Table of Contents

Envision having actually that interest returned to in a tax-favorable account control. What chances could you benefit from in your life with also half of that cash back? The standard idea behind the Infinite Financial Concept, or IBC, is for individuals to take more control over the funding and banking functions in their daily lives.

IBC is an approach where individuals can basically do both. Exactly how is this possible? By having your buck do more than one work. Currently, when you invest $1, it does one thing for you. It buys gas. Or it acquires food. Perhaps it pays a bill. Probably it goes in the direction of a holiday or big purchase.

What if there was an approach that shows people exactly how they can have their $1 do than one job merely by relocating it with a possession that they manage? This is the essence of the Infinite Financial Idea, initially promoted by Nelson Nash in his publication Becoming Your Own Banker.

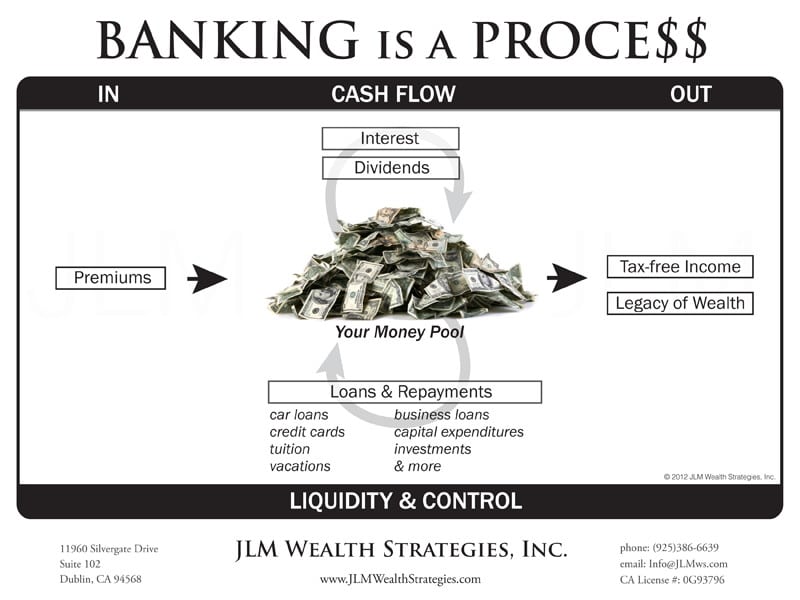

In his book he demonstrates that by producing your own personal "financial system" through a particularly designed life insurance policy contract, and running your dollars via this system, you can significantly enhance your financial situation. At its core, the idea is as straightforward as that. Producing your IBC system can be done in a variety of innovative means without altering your cash circulation.

This belongs to the process. It takes time to expand a system to deal with every little thing we want it to do. Thinking long term is crucial. Just bear in mind that you will certainly be in financial circumstance 10, 20 and even 30 years from now. To get there we need to begin somewhere.

The settlements that would certainly have otherwise mosted likely to a banking establishment are paid back to your individual pool that would have been made use of. The outcome? More money enters into your system, and each buck is performing numerous tasks. Regaining rate of interest and lowering the tax obligation problem is a fantastic story. It obtains even better.

R Nelson Nash Infinite Banking Concept

This money can be made use of tax-free. The money you make use of can be paid back at your recreation with no collection repayment timetable.

This is just how family members pass on systems of wealth that enable the following generation to follow their desires, begin businesses, and take advantage of possibilities without losing it all to estate and inheritance tax obligations. Firms and banking establishments use this strategy to create working pools of capital for their businesses.

Walt Disney utilized this technique to begin his desire for constructing a motif park for youngsters. We would certainly love to share more instances. The inquiry is, what do want? Assurance? Financial protection? A sound monetary solution that does not count on a changing market? To have money for emergency situations and opportunities? To have something to pass on to individuals you enjoy? Are you happy to find out more? Financial Planning Has Failed.

Join among our webinars, or participate in an IBC boot camp, all cost free. At no charge to you, we will show you a lot more concerning just how IBC functions, and produce with you a plan that functions to solve your trouble. There is no commitment at any kind of factor in the procedure.

How Do I Start Infinite Banking

This is life. This is heritage.

We have actually been helping households, entrepreneur, and people take control of their finances for years (priority banking visa infinite credit card). Today, we're thrilled to revisit the fundamental principles of the Infinite Banking Principle. Whether you're taking care of individual funds, running a business, or planning for the future, this concept gives an effective tool to accomplish monetary goals

A common misunderstanding is that unlimited banking revolves around acquiring life insurance policy, but it's really regarding controlling the procedure of funding in your life. Nelson Nash, in his publication Becoming Your Own Banker, makes this clear. The core concept is that we fund whatever we buyeither by obtaining cash and paying rate of interest to somebody else, or by paying cash and shedding out on the interest we might have earned in other places.

Some might claim they have an "limitless financial plan," but that's a misnomer. There's no such thing. While specific plans are created to apply the Infinite Financial Idea, Nelson discovered this procedure utilizing a typical entire life insurance coverage policy he had actually bought back in 1958. Quick onward to the very early 1980s: rate of interest rates rose from around 8.5% to over 20%, and Nelson encountered large passion repayments$50,000 to $60,000 on a business funding.

Nelson got a statement for his State Ranch life insurance coverage plan. He observed that for a $389 costs, the cash money value of the policy would increase by nearly $1,600.

This awareness marked the genesis of the Infinite Financial Principle. Several people stay at the grace of fluctuating rate of interest rates on home mortgages, home equity lines of credit report, or organization financings.

Infinite Income Plan

Nelson's insightdeveloping and controlling an individual pool of cashallowed him to browse these challenges with self-confidence. Nelson purchased his plan for its death benefit. But gradually, the money worth expanded, developing an economic resource he could use through plan lendings. His history as a forester provided him a special lasting viewpoint; he assumed in regards to decades and generations.

Nelson was investing in a policy that wouldn't have cash value for 2 or 3 years. This brings us to the essence of the Infinite Banking Principle: it's regarding just how you utilize your cash.

With your very own pool of cash, the possibilities are unlimited. This suggests valuing your money the same way a bank values theirs.

The real power of this system hinges on its adaptability. Passion prices vary in time. When bank fundings were at 2-3%, some picked not to obtain versus their policies. But as financial institution prices reached 8-10% while plan fundings remained at 5%, those with foresight and a well-structured plan took pleasure in the freedom to borrow on extra positive terms.

Importantly, infinite financial doesn't need way of life sacrifices. It's concerning making smarter options with the money you currently spend. Rather than counting on exterior funding, you fund your buy from your own swimming pool of money, preserving control and adaptability. This system can take place forever, benefiting you and future generations. Obtaining started is straightforward: start where you are.

At its core, limitless banking enables one to utilize one's cash value inside their whole life insurance plan rather than depending on typical financing from banks or various other creditors. It does this by utilizing the person's insurance coverage and its equivalent cash value as collateral for the car loan. "Insurance coverage," in this instance, usually describes, which covers an individual's whole life (unlike, which just covers the insurance policy holder's recipients in case of death).

Bank On Yourself Insurance Companies

Insurers usually process such demands without trouble given that the collateral is already in their hands. They can easily take possession of it if the policyholder defaults on their settlements. Most importantly, the system offers substantial tax obligation savings given that dividends from cash-value life insurance policy plans are exempt to revenue tax.

Latest Posts

Becoming Your Own Banker Explained - Round Table

Life Insurance As A Bank

Infinite Family Banking